A product that takes my breath away

Introducing Robinhood: a $0 commission stock trading app that hits the bull’s-eye.

In 2014, co-founders Vlad Tenev and Baiju Bhatt launched the Robinhood app with the description “by-far the most beautiful brokerage app ever.”

After graduating from Stanford, Vlad and Baiju built trading products for wall-street when they discovered that it only costs a few pennies to execute a transaction but brokerage firms were charging $7–$12 for every buy or sell order (the transactions could be executed entirely electronically). So they decided to launch a company together, their third attempt at starting a company, and turns out, third time’s the charm.

By launch day, the duo had a lot to be proud of. Apart from accomplishing the herculean task of passing through security and regulatory hurdles, Robinhood had also figured out:

- A value proposition for a specific user profile — free stock trading for smart-phone obsessed millennials, like me, who are starting to invest

- A delightfully effortless user experience — easy to understand, minimalistic design, beautiful animations, and a stunningly coherent brand identity

- A marketing campaign that led to almost 1-million users signing-up before the launch and helped the company build a scale-able customer acquisition strategy

Below, I’ll explain why I’m in love with Robinhood’s approach to product management based on the same three pillars — focusing on the Value Proposition (pricing strategy), UX, and marketing. I’ll throw in some facts about the product’s evolution, infer some metrics and conclude with some ideas about how to improve the platform further.

Since product strategy is a reflection of business strategy, I’ll use the term Robinhood interchangeably for the company and for their mobile app (the product). Also, I’ll use the umbrella term stock to represent all the securities that can be traded on the platform.

Value Proposition via pricing strategy

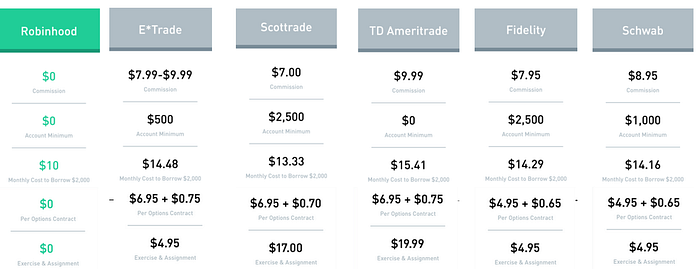

Robinhood’s core value proposition is simple — save money on every trade.

So what’s their pricing strategy? Free.

Their success has already forced prices down industry wide but Robinhood intends to maintain its competitive edge by keeping human capital costs low and avoiding the overhead of building and staffing brick & mortar retail storefronts.

But how do they make money?

The company has two sources of revenue:

- Interest on float. This is probably not a large source of revenue when interest rates are so low, but it will grow if the government continues to hike rates.

2. Robinhood Gold. Most brokerages allow users to trade with borrowed money and charge 8% –10% interest on the borrowed amount. Robinhood realized that people don’t want to calculate how much interest costs works out to (note to self, always help your customers avoid mental math). So they introduced a simplified margin trading product — charging a subscription fee every month based on how large a credit line you were being offered.

Eventually they could charge for access to their API and introduce paid services for more active investors.

User Experience that delights

Fundamentally, Robinhood’s users seek three core things from the app:

- Research: Users want to learn more about what to buy and sell

- Trading Choices: Users want a comprehensive choice of securities that can be bought and sold so they don’t have to go to other platforms to apply different investment ideas

- Speed: Users want quick, effortless ways to act on information and execute trades

Knowing this, Robinhood continues to evolve the product capability and user experience by improving these key points: 1) information display, 2) product mix, and 3) access; while maintaining a great UX.

1. Displaying Information:

Robinhood tries to display a lot of information as cleanly as possible. It uses a few different levers to keep things simple: colors, charts, news cards and statistics. I’ll talk about all of these below, but first, here’s a quick overview of the app’s UI.

- Colors: The entire app is themed white when the markets are open and trading is allowed, black when the markets are closed and trading isn’t allowed. When looking at each stock, the information is displayed in green when the price is up for the day and red when the price is down. In a single glance, a user can understand what kind of trading options are available and how the security is performing that day.

- Notifications: Notifications from Robinhood alert users to news pertinent to their portfolio and watch-list. These notifications also tempt people to come back and use the app multiple times everyday, it’s the first time I’ve seen an addictive financial app!

- News Cards: A while after the app was launched, Robinhood introduced news cards (which you navigate with swipes). Robinhood displays news cards on the home page. offering interesting information like the shares that gained / lost the most value that day.

- Buy/Sell Orders: Orders can be triggered within a couple of taps. After I key in my order details, I swipe up and it feels like I’m sending off my order to be executed. There are also options to trigger trades based on prices (limit-buy, stop-loss, etc).

- Earnings chart: The company recently added features that overlay earnings expectations and results from the past few quarters in to each stock page. They also added an integration that allows listeners to listen to earnings calls live via the app.

2. Product Mix

The team added different securities that can be traded on the Robinhood platform. They started with US stocks. Then added ETFs. Then added margin trading via a feature called Robinhood Gold (their first revenue generating feature). Recently they’ve added free options trading.

3. Speed

Transaction speed can be increased by increasing access to multiple platforms so that the user doesn’t always have to keep returning to their phone. Robinhood originally launched as an iOS app only. Next they launched an Android app. Then an app for the apple watch. Recently, they’ve introduced a web app that uses the larger screen space to offer better research tools. I think they’re exploring the idea of offering API access in the future.

Another way to increase speed is to execute trades quickly. Originally, the app used to take 3 days to process deposits and withdrawals which caused a lot of grief when people wanted to participate in a trade quickly. In 2016, Robinhood allowed instant fund transfers via a feature called Robinhood Instant and relieved that pain point.

As the product features improve, there’s more usage.

How Robinhood Nails Marketing virality

How they marketed when they launched the company

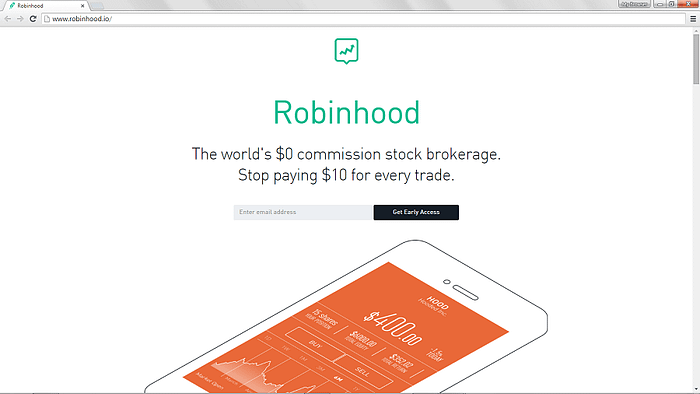

Even before they bought the .com domain name, the Robinhood team put up an early access sign-up page(on robinhood.io) with a simple mockup and value proposition — ‘stop paying up to $10 for every trade’. This campaign validated the idea and the waiting list triggered multiple psychological responses that helped the campaing achieve virality. In the end, Robinhood had almost 1,000,000 sign-ups before a product was even released to the public.

How they market new feature announcements today

Robinhood uses three marketing techniques to trigger psychological responses that make most of its campaigns go viral.

Close to launch date, Robinhood offers media outlets a chance to review the feature. They write about it and generate buzz. People read the reviews which encourage them to sign up for early access. And then a virtuous cycle begins.

- People sign up for early access because the idea of missing out on more free things triggers people’s fear of missing out (FOMO).

- Once they sign up for early access, Robinhood shows them their position in the queue — which triggers a feeling of envy.

- Then Robinhood offers to move you up the queue if you refer other people to sign up. This triggers people’s competitive spirit because early adopters prefer to be the earliest adopters, rather than the bottom of a queue.

- Once they start referring people, network effects kick in and the virtuous loop accelerates.

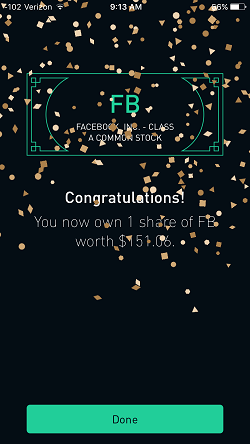

How they acquire new customers — more referrals

Instead of paying people a few dollars for each referral like most startups, Robinhood uses a novel incentive to acquire new customers. Co-founder Baiju says “we were thinking about how we could offer a new customer one unit of our service whenever they were referred to us. Uber offers a free ride, so we decided to offer a free stock! And of course, they gamified it. So now, every referral comes with a guaranteed stock that could be anything a share of ford or a share of Facebook. I keep getting Groupon shares.

From this online survey of the shares people have received, the probabilities are:

- ~80% chance the stock has a value of $3-$10;

- ~18% chance the stock has a value of $10-$50;

- ~2% chance the stock has a value of $50-$150.

Which gives us an expected value of (80% * $6.5 + 18% * $30 +2% *$100) times 2 shares per referral. So CAC = $25.

I don’t have data on the lifetime value (LTV) of Robinhood’s customers but I suspect the company is currently choosing growth over profits. It helps that Robinhood’s average user age is 27, compared to E*Trade’s 55. The idea that its customers won’t die off anytime soon must be reassuring for the startup.

At any rate, their growth curve is impressive and Vlad Tenev’s confidence is reflected in his words “ when you move money around, it never seems too tough to earn some for yourself.”

The Market

Robinhood has surpassed its closest incumbent competitor E*Trade in terms of user growth. In response, E*Trade has shifted focus away from casual investors to active traders. According to Investopedia “[E*Trade] has been at the online brokerage game since 1982. As of the end of last year, the company had roughly 3.6 million brokerage accounts. In under two years, Robinhood has been able to bring on nearly as many customers as E*Trade has in 35 years.” It feels like Blockbuster and Netflix when you look at these metrics.

However, now Robinhood has to look beyond traditional stock brokerages at the entire fintech landscape. It has to compete with all the investment and wealth management businesses out there, and there are plenty.

The good news is that people already trust Robinhood, so it could have an easier time taking market share from the other players.

What’s coming next?

Crypto. Duh.

With Coinbase surging in popularity, and Cryptomania taking off amidst speculators around the world, Robinhood announced the launch of free cryptocurrency trading and had a million users sign up for early access IN 2 DAYS. Bitcoin (BTC) and Ethereum (ETH) appear like just another asset class in the home page but once someone is trading cryptocurrencies, the Robinhood app turns on the futurism with color schemes going purple and numbers display a glitch every time the price changes.

Opportunities for the future

I’ll offer recommendations to further the goals of Robinhood in terms of 1) displaying information, 2) enhancing product mix, and 3) increasing access.

- Information

- More news cards: News cards work on the home screen but they have not been implemented while browsing the screen dedicated to a particular stock. I recommend implementing news-cards at each stock level as well.

- Enhance Charts: Robinhood’s app displays a the total value of your portfolio over time on the home page and displays a price chart at the top of every stock page. However, it hides the scale on the y-axis and users have to touch the segment of the graph to see the stock’s value at that time. This is quite annoying. While it helps de-clutter the interface, it violates one of the cardinal rules of data visualization — which is to show an accurate range. I recommend displaying upper and lower bounds values on time-series charts.

- Allow other charts: Allow different metrics to be displayed as a time series when a user clicks that variable in the statistics card. It might pose a challenge depending on what data you store for each security over time but since earnings are stored, displaying a P/E time-series seems feasible.

2. Diversify the product mix further

Now that Robinhood has gained its users’ trust and proven that the product is as secure as any financial product out there, it can invite people to put more assets under its management by diversifying its investment/wealth management offerings.

Robinhood offers $0 commission active investing as the answer to two of the core reasons people hesitate to invest in the stock market: (lack of knowledge and high cost). However, there are other types of services that serve these needs too: wealth management services like Betterment and Wealthfront, and micro-investment services like Acorns and Stash.

Robinhood could enter these markets and offer a free robo-advisory service for people who don’t want to actively invest. It could allow people to rollover their 401(k) and IRA balances. This would increase the company’s AUM metrics and lower their cost of capital to continue lending to margin traders via Robinhood Gold.

3. Diversifying channels

Robinhood is already working to provide API access to its service. I think this notion can be taken one step further. Trading options could be embedded within websites just like this Medium article offers people the ability to tweet a line directly. It makes sense because most news sites like the WSJ offer stock quotes within their articles and maintaining this stock price service must cost them resources. Instead, Robinhood could take over that service and increase its trade volumes because reading the news often triggers stock purchases and sales.

In conclusion

There have been previous (and subsequent) attempts to provide a brokerage service while charging zero commissions. Frankly, those attempts have failed because it is super difficult to provide a robust financial product at razor thin margins. But Robinhood seems to be executing on the idea better than any conceivable expectations. They have raised $176 million from investors like Index Ventures and DST Global and are currently valued at $1.3 Billion.

With 3 million customers, Robinhood has only penetrated 1% of the US population and less than 0.05% of the world’s population. They have a lot of room to grow.

There’s very little that can halt the momentum of this thundering Unicorn other than a large security breach. Like the Robin Hood in English folklore, this small team of engineers and designers is trying to enrich the masses. So far, Robinhood claims to have saved users over $1 Billion in trading fees. Their flagship mobile application continues to provide a stunningly easy user experience for amateurs and professional investors alike. And their marketing prowess is legendary.

I would highly recommend that you try Robinhood (and if you do, use this code: prateej1, so we can both get free stock!)